The UK’s Most Reliable CIFAS Marker Removal Service, charged at the Cheapest Fixed-Fee Rates & protected by a Full Money-Back Guarantee.

Hassle-Free CIFAS Marker Removal

Leave the Hard Work to Us

Relax and regain your financial freedom while we do the heavy lifting.

BENEFITS

“Quality is not an expense, it’s an investment in your future.”

Starting at just £549.00 GBP, see your CIFAS Marker removed within just 8 weeks.

Regularly updated weekly, regardless of an update or not as we want to keep you in the loop

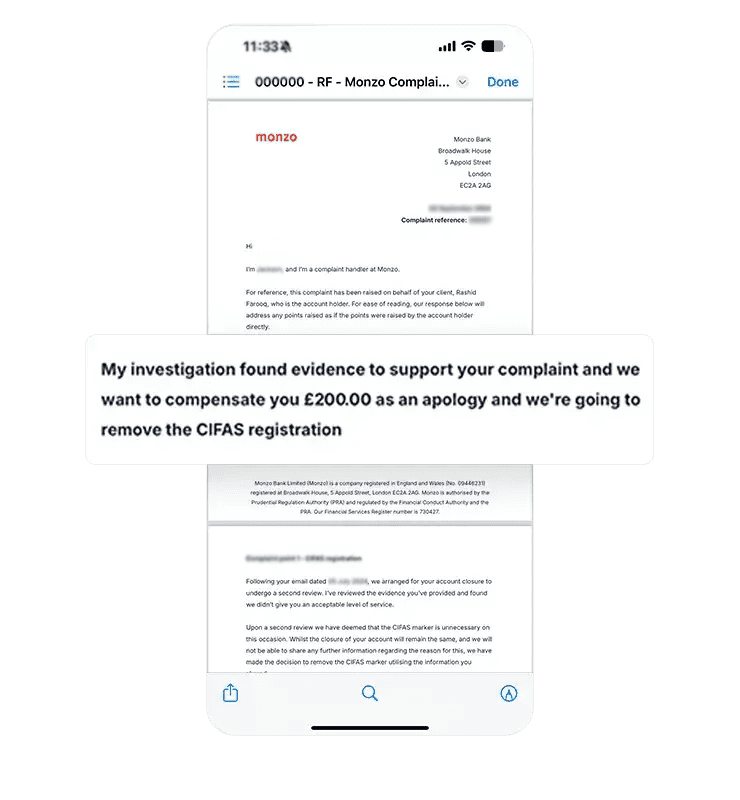

With our service your CIFAS Marker successfully removed or your money back, guaranteed.

Welcoming our Instalment Plans. Pay in instalments at your pace no credit check involved.

Our services contain a 99.4% Success Rate, regardless of the type of case or bank / creditor.

Our firm is rated 5 Stars

and we’ve submitted over 2000 removals for CIFAS Markers to date.

Choose the best plan for your CIFAS marker removal needs.

Ideal for basic CIFAS marker removal.

Best for thorough marker removal with an expedited case and response.

For complete peace of mind.

A CIFAS marker can be devastating for young people, particularly because it stays on record for up to 6 years, affecting every aspect of financial and personal growth during this crucial period. Specifically, it can:

Imagine starting adult life with all these roadblocks simply because of one marker. This isn’t just about finances—it’s about your future.

We understand the anxiety a CIFAS marker can cause. That’s why we provide consistent updates every three to seven days through WhatsApp, along with email notifications. For clients in our premium package, a personal case manager will be available 24/7 for instant updates.

Yes. A CIFAS marker can indirectly affect your family’s financial situation:

We aim for a rapid resolution, with most cases seeing a response within 7 to 21 days after submission. Our premium service offers same-day submission and prioritised handling to expedite the process even further. However the FCA allows all members of CIFAS up-to 8 weeks to conclude their investigations.

Absolutely. CIFAS markers are visible during employment checks for positions in:

We aim to make our services accessible and flexible. Therefore, we accept the following payment methods:

Hayat Private Legal Services Ltd is a distinguished legal consultancy firm specializing in CIFAS marker removal and financial dispute resolution. Established on 26th November 2024, and headquartered at 71-75 Shelton Street, Covent Garden, London, United Kingdom, WC2H 9JQ, we are dedicated to advocating for clients facing unjust CIFAS markers and financial challenges. Our consultancy operates under the directorship of Sheikh Ahmed, a seasoned Financial Legal Consultant renowned for strategic case handling and effective resolution of financial disputes.

We are not regulated by the Solicitors Regulation Authority (SRA), as we conduct non-reserved legal activities. This enables us to liaise privately with banks and financial institutions, utilizing strategic communication and advocacy without representing clients in court. Our work adheres to the highest standards of professionalism and ethics, ensuring effective representation within the permissible scope of non-reserved legal work.

Hayat Private Legal Services LTD trading as HPLS. Registered Office: 71-75 Shelton Street, WC2H 9JQ, Covent Garden, London, United Kingdom. Registered number 16102285. Registered in England and Wales. www.hayatlegal.co.uk .Unregulated by the Prudential Regulation Authority and the Financial Conduct Authority. HPLS and its logo are registered trademarks.

© HPLS. All rights reserved.